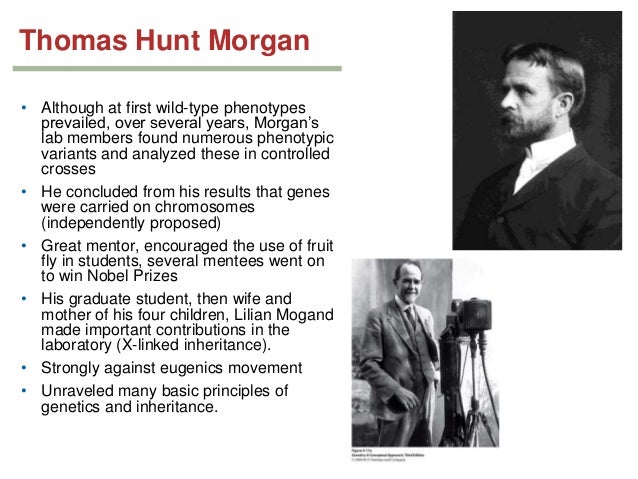

The change also lightened his workload considerably. Morgan & Co., Inc., a publicly traded corporation, to help protect its assets. Morgan & Co., a private banking firm, into J.P. As war approached, he scaled back his holdings as he watched his fortune continue to shrink. In all, Morgan and his firm faced at least four congressional investigations.īy the time of the Nye Committee, Morgan was semi-retired from the day-to-day operations of his company. The stress of the hearings may have directly contributed to the heart attack Morgan suffered four months later. Nye, chair of the Munitions Committee, spent a month closely questioning Morgan and two of his associates over their role as "merchants of death." The Nye Committee finally decided that there was no evidence of wrongdoing. Some argued that American bankers did this in order to protect the huge loans they floated to the Allies. In 1934 allegations surfaced that the financial community had been instrumental in maneuvering the United States into World War I on the side of The Morgan firm elected to become a private commercial bank. The committee's finding that the twenty Morgan partners had paid nothing in federal income tax for the previous two years (all perfectly legal but seen as somehow dishonest and immoral) contributed to the passage of the Glass-Steagall banking bill, which separated investment from commercial (deposit) banking. Pecora's efforts failed to turn up anything illegal, but he did succeed in tarnishing the reputation of both Morgan and his company. The Pecora Committee was dismissed by some as political theater, but not before Pecora tried to discredit Morgan by publicly examining his business affairs in an attempt to find wrongdoing. The Senate Banking and Currency Committee, which retained Ferdinand Pecora as special counsel in 1933, launched an investigation into the activities of the securities business and the stock market.

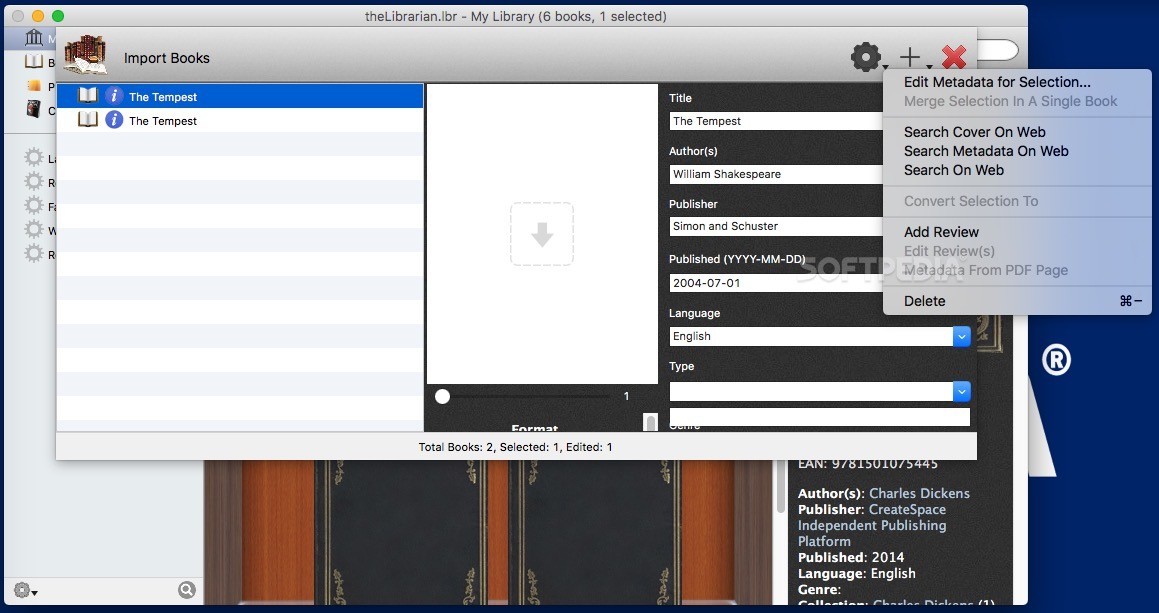

#WHO WAS THELIBRARIAN WHO CONTRIBUTED THE MOST TO THE MORGAN SERIES#

From 1933 to 1941, congressional committees conducted a series of investigations into Morgan-managed foreign loans. Morgan's public statements supporting laissez-faire business views did little to help his image or that of the banking industry. Even Nazi anti-American propaganda accused Morgan of contributing to Germany's problems. Nonetheless, Morgan was frequently the subject of suspicion and conspiratorial rumors and he became a leading target of politicians who sought scapegoats for the nation's economic woes. In 1929, Morgan served on the Committee of Experts to advise the Reparation Commission about Germany's war reparations.Īt the onset of the Depression, Morgan's firm helped prevent retail banks from closing their doors and tried to save several companies from failing. Unabashedly pro-British in his public sentiments, in July 1915 Morgan was the target of a mentally deranged German sympathizer who shot and wounded him. Morgan secured billions in loans during and after World War I for Britain and France. When his father died in 1913, Jack took over the firm.

The most important American financier of his day, Jack was the target of both politicians' barbs and an assassin's bullets during his career.Īfter graduating from Harvard University in 1889, Jack joined his father's firm in 1892 and worked in the firm's London branch for eight years. John Pierpont Morgan, Jr., or "Jack," was the eldest son of John Pierpont Morgan, the most powerful American banker and financier of the late nineteenth and early twentieth century. (September 7, 1867–March 13, 1943) was a prominent American banker and financier who served as head of the Morgan investment banking house for thirty years.

0 kommentar(er)

0 kommentar(er)