- #Utah generally accepted auditing standards code

- #Utah generally accepted auditing standards professional

Since the standards of accounting standards were released, the ASB has started a new set of standards that overlap the existing one. Standards of reporting consisted of four standards dealing with financial statements, basis for audit opinion, and the connection of financial accounting with GAAP. The standards of fieldwork consisted of three standards that covered acceptable and expected procedures in the field.

#Utah generally accepted auditing standards professional

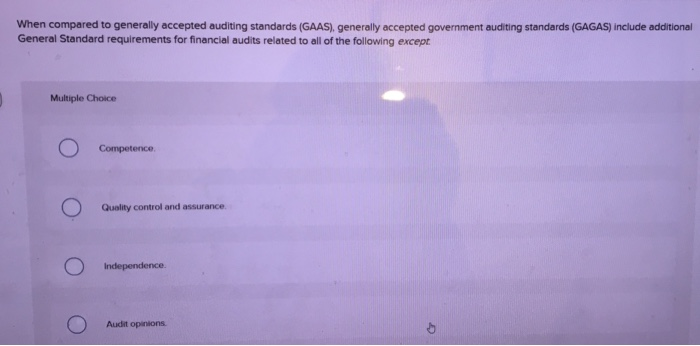

General standards consisted of three main standards dealing with professional competence and ethics. The Auditing Standards Board created a framework of auditing standards that was divided into three main sections: Auditing Standards The Auditing Standards Board, a part of the American Institute of Certified Public Accountants, creates GAAS to establish auditing practice standards and rules. Texas Vernon's Civil Statutes > Title 22 - Bonds-County, Municipal, Etc.Definition: Generally Accepted Auditing Standards are the rules that govern auditing practices in the United States.Illinois Compiled Statutes > Chapter 30 - Finance.Illinois Compiled Statutes > Chapter 20 > Illinois Finance Authority.Florida Statutes > Title XIV - Taxation and Finance.Florida Statutes 218.63 - Participation requirements.Florida Statutes 218.62 - Distribution formulas.Florida Statutes 218.61 - Local government half-cent sales tax designated proceeds trust fund.

#Utah generally accepted auditing standards code

California Codes > Government Code > Title 6.7 - Infrastructure Finance.California Codes > Government Code > Title 2 > Division 4 - FISCAL AFFAIRS.

The board of directors of any nonprofit corporation that receives an amount of money requiring an accounting report under Section 51-2a-201. The governing board of any area agency established under the authority of Title 62A, Chapter 3, Aging and Adult Services The governing board of any substance abuse authority established under the authority of Title 62A, Chapter 15, Substance Abuse and Mental Health Act The governing board of any local mental health authority established under the authority of Title 62A, Chapter 15, Substance Abuse and Mental Health Act The governing board of each interlocal organization having the power to tax or to expend public funds The governing board of each political subdivision

Is performed in accordance with generally accepted government auditing standards, or for a nonprofit corporation or a governmental nonprofit corporation, in accordance with generally accepted auditing standards andĬonforms to the uniform classification of accounts established or approved by the state auditor or any other classification of accounts established by any federal government agency.

0 kommentar(er)

0 kommentar(er)